Every year, the Jackson Hole Economic Symposium in the United States gathers central bankers, economists, and policymakers from across the globe. While it may seem like a US-centric event, the discussions and statements made here—particularly by the US Federal Reserve (Fed)—often influence global financial markets. For India, the outcomes of this meeting can shape currency trends, capital flows, inflation, and even growth opportunities in the coming 2–3 years.

Why Jackson Hole Matters Globally

The Jackson Hole Symposium is not just another conference. It often sets the tone for the Federal Reserve’s monetary policy outlook, especially regarding interest rates, inflation control, and long-term economic strategy. Markets around the world watch these signals closely because:

- The US dollar remains the world’s reserve currency.

- Changes in US interest rates affect global capital flows.

- Investors reallocate funds based on Fed’s outlook on inflation and growth.

Key Implications for India

1. Capital Flows and Foreign Investment

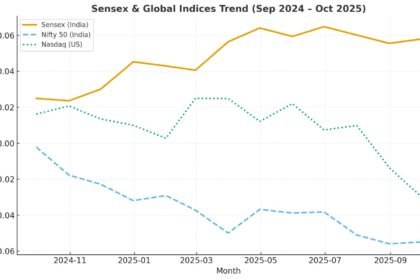

If the Fed signals higher interest rates for an extended period, global investors might shift capital back to the US, making emerging markets like India relatively less attractive. This could lead to short-term outflows from Indian equity and debt markets. Conversely, dovish commentary (suggesting rate cuts) could attract more foreign institutional investment (FII) into India.

2. Rupee-Dollar Exchange Rate

Fed policy directly impacts the strength of the US dollar. A stronger dollar typically weakens the Indian rupee, increasing the cost of imports like crude oil and widening the trade deficit. On the other hand, a softer dollar can stabilize the rupee, benefiting India’s external position.

3. Inflation and Interest Rates in India

Imported inflation is a major risk for India. If the rupee weakens due to Fed tightening, the Reserve Bank of India (RBI) might face pressure to adjust its own interest rates to manage inflation and stabilize the currency. This interplay could affect borrowing costs for businesses and consumers.

4. India’s Growth Story and Global Perception

Global investors don’t just look at India in isolation—they weigh it against the Fed’s guidance. A positive Fed outlook on global growth can complement India’s domestic growth story, making it more attractive for long-term investors.

Outlook for the Next 2–3 Years

- 2025–2026 will likely see a shift from aggressive inflation control to more balanced policies by the Fed.

- India, being one of the fastest-growing major economies, could benefit if global liquidity improves.

- However, volatility in currency and equity markets will remain tied to Fed actions and communication.

Final Thoughts

The Jackson Hole meeting is a reminder that India’s economy, though strong in fundamentals, is not immune to global monetary trends. For businesses, investors, and policymakers in India, tracking the Fed’s commentary is essential to anticipate shifts in capital flows, inflation, and growth opportunities.

In short, what happens in Wyoming can ripple all the way to Mumbai—making Jackson Hole’s annual discussions crucial for India’s economic roadmap.

Disclaimer

This article by SalesBazaar is written for editorial and informational purposes only and does not claim affiliation unless explicitly stated. All insights are independently written for the benefit of our readers.