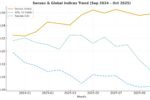

Since September 2024, India’s benchmark stock index — the Sensex — has suffered negative returns. For many investors, this has been a source of concern and introspection: is this just a temporary dip, or a structural shift? Let me walk you through the likely causes, the cracks in confidence, and possible paths forward.

What the Numbers Show?

When you trace the Sensex from September 2024 to date, you see a steady downtrend. Losses are not across the board — certain sectors held up better, while others were hit harder. But overall, portfolios that were aggressive in mid-2024 have taken a hit.

Possible Catalysts Behind the Downturn

- Global Rate Pressure & Tightening: Rising U.S. and global interest rates have put pressure on capital flows. Emerging markets like India become less attractive when yields elsewhere rise.

- Inflation & Cost Pressures: Persistent inflation—especially in energy, raw materials, and food—eroded margins for many firms. Investors began to factor in lower profit growth.

- Policy Uncertainty & Regulation: Regulatory changes, new tax proposals, and the specter of tariffs or trade restrictions have spawned caution, particularly in sectors like pharma, chemicals, and exports.

- Earnings Disappointment: Some companies failed to meet lofty expectations in revenue or margins turns. Analysts and fund houses have downgraded segments they once backed.

- Global Macros & Risk Aversion: Slowing global demand, geopolitical tensions, or fear of macro shocks may have driven investors toward safe havens, pulling money out of equity markets.

What It Signals for Investors and Markets

- This is not just a “correction” — it may reflect a change in sentiment about growth vs. valuation.

- Sectors with stable cash flows, dividends, or defensive business models might fare better.

- Investors should re-examine margin sensitivity, debt levels, and resilience to external shocks.

- Volatility may remain higher for another 6–12 months as markets try to price in new realities.

How Could the Slide Reverse?

- Rate cuts or signals from central banks could ease pressure.

- Stronger policy clarity from the Indian government (on taxation, trade, subsidies) might restore confidence.

- Earnings rebound from key sectors — especially export-oriented or consumption segments — could provide momentum.

- Capital inflows returning, particularly from foreign institutional investors, would help reverse the slide.

Final Thoughts

Markets often discount what may happen before it becomes reality. The Sensex’s negative return since September 2024 might be telling us deep things — about global capital, inflation, confidence, and structural shifts. For astute investors, these times demand patience, selective exposure, and stress-testing against downside risks.

Disclaimer This article by SalesBazaar is written for editorial and informational purposes only and does not claim affiliation unless explicitly stated. All insights are independently written for the benefit of our readers