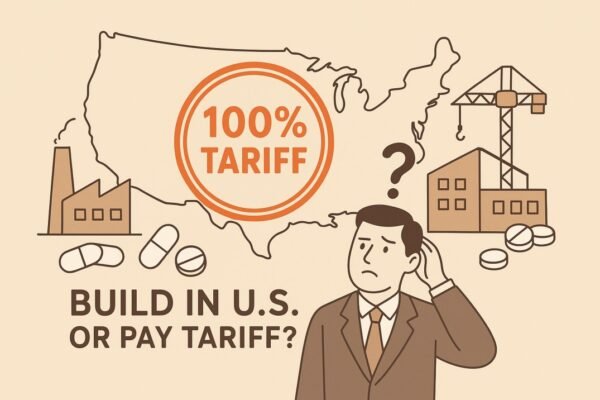

In a sweeping move announced this month, the U.S. administration declared plans to impose a 100% tariff on imported branded or patented pharmaceutical products, effective October 1, 2025. The twist: companies that are actively building U.S. manufacturing plants—that is, projects already breaking ground or under construction—may qualify for an exemption under the rules laid out.

This announcement has sent ripples across global pharmaceutical markets, including in India, which is a major exporter of both generic and patent medicines. Below, I break down how this could play out, where the risks lie, and what steps markets and companies should consider.

Reasons Behind the Tariff Move

From what I can read between the lines, a few motives seem clear:

Push for domestic drug manufacturing: By making imports costlier, the U.S. is incentivizing pharmaceutical companies to produce locally rather than rely on overseas sourcing.

Strategic negotiation leverage: The tariff functions as a pressure tool. Some firms may accelerate investment in U.S. plants to preserve access to the American market.

Fiscal & political signaling: Tariffs can be a way to appeal to domestic manufacturing and economic sovereignty narratives.

Possible Upsides & Exemptions

- Exemption for U.S. plant builders: Firms that have begun constructing or expanding U.S. drug manufacturing facilities may avoid the 100% tariff.

- Generic drugs likely safer: Early interpretations suggest that the 100% levy targets branded and patented pharmaceutical products, not generic medicines—a crucial distinction that may protect many Indian drug exporters whose strength lies in generics.

- Competitive shift: Companies already investing in U.S. footprint may gain relative advantage.

- Cleaner supply chains: Increased U.S. production could reduce dependency and supply vulnerabilities.

Risks & Challenges

- Profit pressure for exporters: For Indian pharma firms exporting patent drugs to the U.S., margins could be squeezed dramatically if prices don’t adjust to absorb the tariff.

- Market uncertainty and pricing volatility: Sudden tariff levels can trigger price swings, contract renegotiations, and supply chain disruptions.

- Exemption ambiguity: What exactly qualifies as “building” or “under construction” may be contested. Legal disputes and regulatory interpretation battles are likely.

- Impact on innovation: Smaller companies or those without capital to invest in U.S. plants may face barriers to access the U.S. market, stifling innovation or blocking growth.

- Distortion in global trade: The move may shift trade patterns, affecting nations that rely heavily on drug exports, including India.

Implications for India

- Indian pharma exports: India is a global leader in generic drug production and some patented medicines. The tariff may diminish competitive edge in U.S. markets for patented drugs.

- Incentive to invest in U.S. or shift to generics: Some Indian companies may accelerate setting up manufacturing bases in the U.S. or focus more on generics and non-patented medicines.

- Domestic R&D push: To stay globally relevant, India may further emphasize innovation, patents, and value-added pharmaceuticals.

- Trade diplomacy: This would require trade talks, negotiations and possibly retaliation or reciprocity measures via bilateral or multilateral frameworks.

What to Watch & Strategic Moves

- Clarification on exemptions: The rules defining which companies qualify for tariff avoidance will be critical.

- Legal challenges: Expect pharmaceutical firms, trade groups, or even nations to challenge the tariff in courts or through trade bodies.

- Investment pace in U.S. facilities: Firms may accelerate their U.S. manufacturing plans to fall under exemptions.

- Supply chain reconfiguration: Imports, licensing agreements, or third-country manufacturing may see strategic shifts.

- Domestic policy response in India: Incentives, subsidies, or support for export competitiveness and R&D may be needed.

Bottom Line

The 100% tariff on imported branded or patented pharmaceutical goods is a bold, headline-grabbing policy. On paper, it pushes for reshoring and rewards investment in U.S. manufacture. In practice, it raises substantial uncertainty, especially for companies in India that export patented drugs. The balance of exemptions, legal definitions, and strategic adaptations will determine whether this ends up as a showpiece threat or a deeply transformative shift in global pharma trade.

Disclaimer This article by SalesBazaar is written for editorial and informational purposes only and does not claim affiliation unless explicitly stated. All insights are independently written for the benefit of our readers