India launched its fiscal year on a surprisingly strong note. In Q1 FY26, the country posted an impressive 7.8% GDP growth, significantly higher than the projected 6.8%. This performance marks the best start to a fiscal year in over a year and reflects robust economic momentum.

What’s Driving the Growth?

1. Services Sector Takes the Lead

The services industry—spanning trade, hospitality, transport, and communications—emerged as a powerhouse, benefiting from renewed consumer activity, tourism, and connectivity services. It proved to be the fastest-growing sector this quarter.

2. Surge in Government Capital Spending

Government investment received a massive boost, with capital expenditure jumping about 52% year-on-year. This front-loaded spending supported infrastructure development and stimulated allied industries.

3. Strong Performance in Construction, Manufacturing & Agriculture

Construction grew markedly, fueled by both public and private investments.

Manufacturing delivered a healthy expansion, maintaining industrial momentum.

Agriculture, supported by monsoon-driven rural demand, also contributed solidly to overall growth.

4. Consumption and Supportive Indicators

Consumer demand remained resilient, aided by rising employment and consumption levels. Indicators like GST collections, cargo traffic, and steel production all signaled sustained economic activity.

What Could Temper Growth Going Forward?

- Trade Headwinds—Elevated tariffs on exports could undermine India’s competitiveness and dampen manufacturing and merchant activity.

- Corporate Profit Concerns—Disinflation and weak pricing power may pressure company margins and dampen future investment.

- Global Slowdown Risks—Sluggish global demand may impact exports and cap growth potential in the coming quarters.

Outlook for FY26

Growth projections for the full year remain more conservative—hovering in the 6.2% to 6.5% range—as global uncertainties and trade tensions weigh in. Yet despite this, India stands strong compared to most major economies, thanks to its dominant domestic demand base and infrastructure push.

What This Means for Stakeholders

- Businesses can capitalize on booming infrastructure spends and rising urban and rural demand.

- Consumers may benefit from better income and spending power, especially in tier-2 and tier-3 regions.

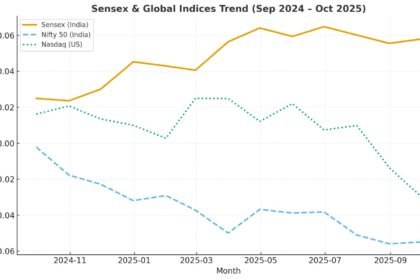

- Investors should remain upbeat—but vigilant, as external trade risks and corporate softness may require a balanced long-term strategy.

The Bottom Line

India’s 7.8% GDP growth in Q1 FY26 is not just a number—it’s a story of resilience. Propelled by activeservices, strong infrastructure spending, and robust consumption, the growth feels both broad and structural.

However, the real challenge lies ahead. Sustaining this momentum will require navigating global trade disruptions and strengthening private sector investment. India’s domestic engine remains strong—but global headwinds are unmistakable.

Disclaimer: This article by SalesBazaar is written for editorial and informational purposes only and does not claim affiliation unless explicitly stated. All insights are independently written for the benefit of our readers.